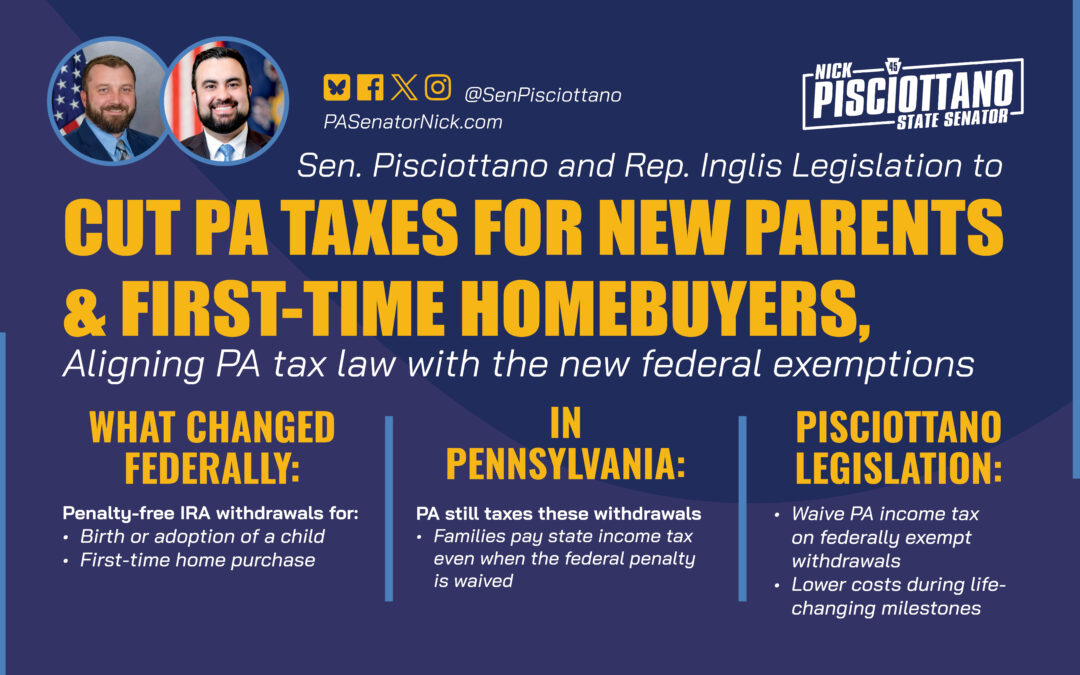

Monroeville, PA – State Senator Nick Pisciottano (D-Allegheny) and State Representative John Inglis (D-Allegheny) announced today they are circulating co-sponsorship memos and plan to introduce legislation that would cut Pennsylvania income taxes for new parents and first-time homebuyers who access retirement savings under updated federal rules.

Recent changes to federal tax law allow individuals to withdraw funds early from an IRA or retirement account without paying the federal 10 percent penalty for specific life events, including the birth or adoption of a child and the purchase of a first home. Under federal rules, each parent may withdraw up to $5,000 per child within one year of a birth or adoption, and first-time homebuyers may withdraw up to $10,000, without paying the early withdrawal penalty. Despite the federal penalty being waived, Pennsylvania continues to tax those withdrawals as ordinary income under the state Personal Income Tax.

The legislation would align Pennsylvania tax law with federal exemptions by waiving the state Personal Income Tax on early retirement withdrawals that already qualify for penalty-free federal treatment.

Pennsylvania is facing long-term challenges related to population growth, housing affordability, and retaining young families. The proposal addresses those pressures by lowering costs when families are welcoming a child or purchasing their first home.

For many households, early retirement withdrawals help address immediate financial needs, including closing costs, adoption expenses, or gaps caused by unpaid parental leave. By eliminating Pennsylvania income tax on federally exempt withdrawals, the legislation would help families bridge those gaps without additional state tax penalties.

“If we want families to stay, grow, and invest in Pennsylvania, our tax code should support them during life-changing milestones,” said Senator Pisciottano. “When the federal government signals that supporting families and first-time homebuyers is a priority, Pennsylvania should build on that momentum.”

Pisciottano and Inglis are working to advance a unified effort in both chambers to align Pennsylvania tax law with federal exemptions and provide relief to families and first-time homebuyers.

“Starting a family or buying a home are enormous financial decisions and some of our state’s outdated tax rules are making those decisions more difficult,” said Representative Inglis. “By aligning our tax code with federal law, this legislation gives families practical relief when they need it most and helps make Pennsylvania a more affordable place for people to put down their roots.”

Senator Pisciottano emphasized that the proposal’s fiscal impact to the Commonwealth would be directly tied to families choosing to grow and residents choosing to invest in homeownership, outcomes that strengthen Pennsylvania’s long-term economic health.

The Senator and Representative are now seeking co-sponsors and plan to formally introduce the legislation in the coming weeks.